Now that Apple Card applications have opened up to everyone in the United States, many are pondering the exact same question: Is the Apple Card worth it? Alas, there isn’t a simple answer to that question; whether or not it’s truly “worth it” varies dramatically from person to person based on everything from their preferred ways to shop to whether they tend to lose their credit cards a lot. The good news, though, is that there are plenty of concrete things to consider that might help you figure out whether an Apple Card would be worth it for you, specifically.

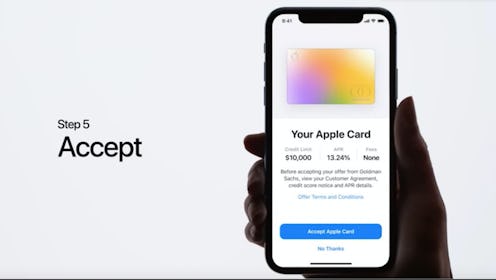

Originally announced this past spring at Apple’s keynote event in March, the Apple Card — which bears the distinction of being the first-ever credit card designed by Apple — rolled out to a limited number of users at the beginning of August. Those who were part of this soft launch received the option in the Apple Wallet app to apply for an Apple Card — a process which could be accomplished in just a few minutes, with approval for eligible users coming through in under a minute, according to The Verge.

At the time, those of us who weren’t part of the limited roll-out were left wondering when the Apple Card would become more widely available — but as it turned out, we didn’t have to wait long at all: As of Aug. 20, 2019, all U.S. residents 18 years of age or over with a valid, non-P.O. box address can apply for an Apple Card directly through their iPhones. The future is now, yadda yadda yadda.

But just because you can do something doesn’t necessarily mean you should do it — hence the ongoing debate over whether an Apple Card is really worth it. Again, it’s largely going to depend on your own wants, needs, and habits; to get you thinking, though, here are a few things you might want to consider before deciding whether or not to apply for an Apple Card:

How Often Do You Use Apple Pay?

The Apple Card’s biggest advantage is its integration with Apple Pay, so if you use Apple Pay a lot, then you’re absolutely going to get the most use out of the Apple Card.

First, there’s ease of use. If your most commonly-utilized way of paying when you shop involves either tapping your iPhone to a contactless payment point of sale or choosing Apple Pay as your payment method when you’re buying something online, then the Apple Card will fit in seamlessly with what you’re already doing — and given that what you’re already doing streamlines the whole shopping process (no fussing with digging out and swiping a physical credit card; no having to type your credit card information in each and every time you want to buy something online; etc.), well, it just keeps the whole thing nice and easy.

Second, you’ll reap the most benefits from the Apple Card’s reward program. As is the case with many credit cards, the Apple Card’s program is a cash-back system; however, Apple’s system is more flexible than most other cash back systems: You earn a percentage of cash back, called Daily Cash, for every single purchase you make using the Apple Card — and you have access to it immediately. Daily Cash goes right to your Apple Cash balance, which you can then use whenever you want with Apple Pay.

The percentage of Daily Cash you earn varies based on exactly how you use the Apple Card; when you use it with Apple Pay, you get 2% for each transaction. So, if you use Apple Pay for most of your purchases already, and your Apple Card is set as the payment method for your Apple Pay account, then you’ll get 2% Daily Cash — that is, 2% cash back — added right to your Apple Cash with every purchase you make using this method, immediately. However, purchases made with the Apple Card that don't utilize Apple Pay only earn 1% Daily Cash — the lowest percentage of cash back the Daily Cash program can yield.

It’s easy to see where the benefits lie for folks who already use Apple Pay a lot. But if you don’t use Apple Pay all that often and aren’t particularly interested in changing your shopping habits — either such that you shop at Apple Pay-compatible stores more often, or such that you just use Apple Pay more frequently in general — then the Apple Card may not actually do much for you.

Do You Want Or Need Detailed Financial Tracking Tools?

One of Apple’s big selling points for the Apple Card is its emphasis on “[helping] customers lead a healthier financial life” through various financial tracking tools integrated with the card and Apple Wallet. As Apple’s VP of Apple Pay, Jennifer Bailey, put it in a press release when the Apple Card was announced in March, the tools are aimed at granting “a better understanding of [consumers’] spending so they can make smarter choices with their money” and offer “transparency to help them understand how much it will cost if they want to pay over time and ways to help them pay down their balance.” If you know you need a little help reigning in your spending — or, heck, even if you’re just interested in seeing the data your spending habits yield — then the dedicated Apple Card tools might be a big plus for you.

Indeed, the tools do seem to be pretty highly regarded; Nilay Patel noted at The Verge when the card began its preview period at the beginning of August that they’re “smarter and simpler” than the ones that make up online financial tracker Mint’s roster of planning tools. Wrote Patel:

“The Apple Card interface in the Wallet app is extremely nice: it provides detailed information about all your purchases, using machine learning to clean up merchant names and categorize your spending over time. You can set payment schedules in a variety of ways, play with a circular slider to see exactly how much interest you’ll be charged, and see how much you’re spending weekly and monthly.”

However, the Apple Card’s planning and tracking tools do have their cons — namely, they’re limited solely to the Apple Card. If you split your spending between a few different methods, then the tools connected with the Apple Card will only show you a small piece of your overall financial picture. And, as Patel noted, other services do already exist that perform these same functions — and typically with a wider scope, at that. Mint’s interface might not be quite as sleek as the Apple Wallet’s Apple Card interface, but on top of having been around for longer, it allows you to add any and all relevant information and accounts to it — credit cards, debit cards, savings and checking accounts, investments, the works.

How Many Apple Devices Do You Regularly Use (And Shop From)?

If you’re a loyal Apple user when it comes to the devices in your life, then shopping online with Apple Pay — and, therefore, shopping online with your Apple Card — are super easy: It’s integrated with numerous iPhone, iPad, Apple Watch, and Mac models, with many of its security features being reliant on you confirming your identity and verifying the purchase directly via the device you’re shopping on using Face ID, Touch ID, or your passcode. If you use multiple devices regularly — say, a phone and a laptop, or a phone and a tablet, or all three, or two plus a wearable, or what have you — and they’re all Apple devices, you’ll be able to use your Apple Card easily whenever you shop at Apple Pay-compatible online retailers, no matter which device you’re using.

If, however, you aren’t uniformly Apple in your device usage — like me! I’m an iPhone user when it comes to smartphones, but a PC user for everything else — then you might get less use out of the Apple Card than an All Apple, All The Time kind of person. The reason is simple: You can’t use Apple Pay on a PC.

Now, it is true that just because you can’t use Apple Pay on a PC doesn’t mean you can’t use an Apple Card on a PC. However, although you can use your Apple Card at online retailers who don’t accept Apple Pay or via a device that isn’t an Apple device, doing so is pretty clunky. You have to go into Apple Wallet, dig up your Apple Card’s virtual card number (which, by the way, is different from both the physical card number associated with the titanium card that comes with your Apple Card account and your device account number), and then manually input that number into the credit number field whenever you make an online purchase.

This whole process sort of eliminates one of the biggest benefits of the Apple Card: Using the Apple Card is supposed to be both simpler and safer than using a standard credit card; in this case, though, you… basically have to use it exactly like a standard credit, with the added hassle of needing to navigate through a bunch of menus on your iPhone to find your card number on top of it all.

How Important Is Extra Credit Card Security To You?

We’ve talked a little bit about how Apple Pay — and, by extension, how the Apple Card — works in terms of its security here; long story short, security experts do generally agree that the Apple Pay system is an improvement over how traditional credit cards work. The Apple Card, however, has some extra features you don’t get just by using a regular credit or debit card with Apple Pay, courtesy of the card’s integration with Apple Wallet — and if you’re someone who values being able to freeze or deactivate a card and request a new card and number easily and quickly, those features might be worth their proverbial weight in gold.

Through Apple Wallet on your iPhone, you can invalidate your virtual card number and request a new one instantaneously whenever you need to. You can also lock your physical card and request a new one through Apple Wallet, too. So, if you, say, need to share your credit card number with someone you don’t totally trust, or you suspect your virtual card number has been breached in some way, shape, or form, you can rest easy knowing you can change your virtual card number at the tap of a button. If you’re prone to losing your physical card, you can also lock it down ASAP until you find it — or you can deactivate it and request a whole new physical card.

Again, though, if you don’t tend to lose your card — or if the extra security doesn’t really matter to you — then the Apple Card may just be a sort of “meh” option for you, rather than a game changer.

How Often Do You Shop Directly With Apple?

Remember that whole “Daily Cash yields different percentages of cash back depending on where and how you shop” thing? You get the biggest percentage of Daily Cash by using your Apple Card at Apple-run retailers: Purchases made at brick-and-mortar Apple Stores, Apple.com, the App Store, and the iTunes store, as well as Apple Music subscriptions, iCloud storage plans, and other Apple-run subscription services all earn a whopping 3% cash back if you use your Apple Card to make them. So, if you tend to shop directly with Apple fairly frequently — or if you’re planning on dropping a bundle with them to upgrade or nab a new device soon — then you’ll see some pretty solid rewards if you’re also an Apple Card user. Again, though, if you don’t shop directly with Apple all that often, then you won’t see that 3% Daily Cash reward terribly frequently.

Obviously these five issues aren’t the only things you’ll want to consider when thinking over the whole should-I-or-shouldn’t-I Apple Card conundrum; they are, however, many of the biggies. If ultimately you do decide to apply for an Apple Card, you can find out how to do so here — but if you don’t, that’s A-OK, too. To each their own, right?

This article was originally published on