Money

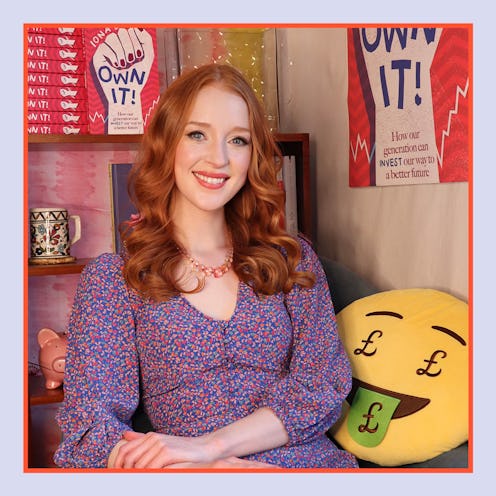

Meet The Money Expert Empowering Women To Become Financially Independent

Plus, 10 expert tips to get more bang for your buck.

When I graduated in the 2010s, I was clueless about money. I was a 22-year-old musician who was chronically bad at maths: financial stuff was dry, boring, and grubby to me. But after the 2008 financial crash, I had to join the real world and get financially savvy. So I started Young Money Blog, the first website dedicated to young people’s finances in the U.K., to learn more about money and (hopefully) help others along the way.

Today, at 33 years old, I write about money for a living, and I’ve become a fierce advocate of financial independence. The latest statistics show that the female employment rate today is 72%, the highest it has ever been, while the gender pay gap remains stubbornly high at 15.4%. It’s clear women are becoming a powerful labour force to be reckoned with. But what’s the point in having these rights if we’re not in control of our money?

If we outsource financial decision-making to others, keep ourselves in the dark about smart money management or rely on spending as emotional therapy, we give up the chance to choose. For me, that’s what feminism is ultimately about: having the chance to choose work, relationships, living arrangements, and a way of life that allows us to flourish.

The latest statistics show that the female employment rate today is 72%, the highest it has ever been, while the gender pay gap remains stubbornly high at 15.4%.

So, my definition of financial independence is the following: the ability to govern your own finances in a way that enhances your own interests, both now and in the future. The question is: How do we develop that ability? Well, it might require a change in mindset as well as some practical strategies. It won’t be easy to break certain habits, and you might have to make some difficult decisions along the way.

But the time, effort, and manageable amounts of money you need to invest in cultivating financial independence will reap huge rewards in the long run. You’ll feel wiser, calmer, full of positivity about the future, and better able to support the people you love. Here are my tips on how to pursue financial independence.

Assess Your Financial Autonomy

There are three ways in which we might lack real financial autonomy:

- We rely too much on someone else’s income and/or outsource important financial decisions to them.

- We spend our money in a compulsive, reactive, or mindless way.

- We keep ourselves in the dark by shunning our bank accounts, financial correspondence, and any relevant news/information out there.

Once you realise the problem, you can start to address it. This might mean creating your own income streams and private current account, keeping a spending diary to identify problematic habits, or simply resolving to sit down with your finances once a week to figure out what’s going on.

Pursue Healthy Boundaries And True Equality In Your Relationships

You’re entitled to keep at least some of your spending private and to have savings you can call your own, even in the most committed relationship. If you make this clear from the outset, this can create healthy boundaries and weed out controlling types. Make sure that all major financial decisions are taken jointly, and if you have any doubts, get a second opinion from a financial adviser, solicitor, or even a trusted friend. You don’t have to commit to anything that makes you feel uncomfortable. Your money, your choice.

Look Out For Economic Abuse

If a partner is pressuring you to lend money, merge all your finances together, and allow them oversight of all of your spending, this can be indicative of abusive behaviour. You can find out more at survivingeconomicabuse.org/what-is-economic-abuse/ (make sure you click on the “exit page” tab on the right side of the screen if you think your partner may check your search history).

Cover Your Ass

Put a legally binding agreement in place if you take on any joint assets (e.g., joint account, mortgage, or credit agreement) with a new partner to clarify what would happen if you split up. A truly supportive, reasonable partner will never object to this.

Put Yourself First

It’s not selfish to invest in your own welfare and goals. In fact, it’s essential if you want enough financial and mental resilience to contribute to worthwhile causes and look after the people you love. But this requires you to say no to people who treat you like an ATM, don’t pay their way, and fail to take responsibility for their mistakes.

Learn About Debt The Easy Way

Debt chaos is common, but it doesn’t have to be an inevitable rite of passage. If you’re concerned about lacking a good credit score to get a mortgage in the future, take out a credit-builder card (like the Tesco Bank Foundation Credit Card), use less than a quarter of the balance for one or two fixed expenses (like a subscription), and set up a standing order just after each payday to repay the full balance. This way, you won’t pay a penny in interest, and you’ll beat the system. Avoid unnecessary debt like store credit and “buy now, pay later” schemes.

Budget Like A Boss

Budgeting allows you to understand what’s coming in and going out so you can make better decisions. A good banking app with budgeting features can help, but you’ll also want to keep tabs on insurance policies, savings, and investments either through a spreadsheet or old-fashioned notebook. If overspending is a problem, try having two accounts — one to pay your bills, the other for “fun” stuff.

Build Your Own F*ck-Off Fund

I aim to have a four- or five-figure sum in savings. This gives me choices in life, including the choice to say “f*ck off” to something — or someone — that might make me unhappy. Your f*ck-off fund might allow you to quit a job you don’t like, leave a miserable relationship, or find a better housing situation. If you’re new to saving, you could try a round-up savings tool (offered by many new digital banks) so it happens automatically when you spend — though putting a multiplier on your savings is much more effective.

Power Up Your Pension

Stay invested in your workplace pension to get free money from your employer and tax relief from the government — put in more if you can, and ask if your employer will do the same (known as “contribution matching”). If you have taken time off work in the past six years, you can buy back any missed national insurance contributions to beef up your state pension. Find out more at gov.uk/check-national-insurance-record.

Invest For Future You

If you invest a two- or three-figure sum each month, you’re creating even more options for Future You thanks to, potentially, the power of the stock market in the long term. Bear in mind that your money is at risk here because there are no guarantees about the stock market’s direction (company shares can go up and down). But you can manage your risks by diversifying your portfolio and leaving it alone to grow (at least five years is the recommended investing time frame). Choose a tax-efficient account, like a stocks and shares or Lifetime Isa to maximise the benefits.

This article was originally published on