Your physical credit cards might want to watch their backs, because there's a new digital one in town. After a soft launch on Aug. 6, the Apple Card finally became available to all qualifying members on Aug. 21. But if you're considering getting one yourself, you might be wondering, "Does the Apple Card cost money?" The simple answer is no, if you're asking about annual fees. But that doesn't mean there isn't any potential cost involved.

If you want to sign up to the Apple Card, there's no joining or annual fees attached to the card. It's really easy to get one, too — qualifying members can apply right from their phone and have one issued almost instantly. The process is quick and free, but that doesn't mean that you shouldn't use caution in opening one — the Apple Card is still a credit card, which means that you will most definitely still be subject to interest fees.

According to their website, Apple is currently offering an APR of 12.99% to 23.99%, depending on your credit-worthiness — aka, your credit score. And while it may be relatively low among credit card interest rates — especially rewards credit cards — it's still a fairly big number, which means interest can add up quick. It's still a credit card, after all.

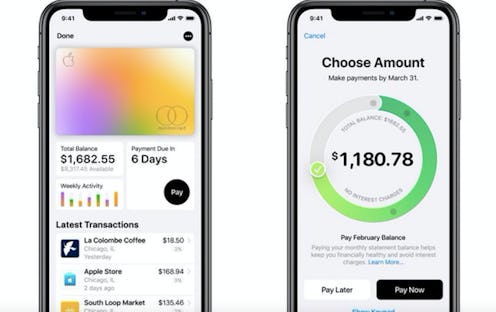

When it comes to interest, though, the Apple Card will be entirely transparent, with your interest rate calculated in real time. You can use that as a measure of whether you want to proceed or not. All of this said, if you pay your balance on time, interest fees won't be an issue, and holding the card is otherwise cost-free.

As long as you're going in with your eyes wide open, there's a lot of perks to consider with the new Apple Card. As previously noted, applying for an Apple Card is uncomplicated and fast — you just open up Apple Wallet on your iPhone, tap the plus sign in the upper right-hand corner, and select "Apple Card" to apply. Secondly, you can use it anywhere Apple Pay is accepted — and if you want to use it somewhere that doesn't have Apple Pay, you can use the white titanium card that you have the option of requesting from Apple when you open your account. Thirdly, it helps you track spending — similar to the Mint app — so you can see where your money is going, helping you save and spend more efficiently. You even get Daily Cash, which gives you 1%, 2%, or 3% cash back depending on any purchases you've made — it goes to a section of the app where you can spend it how you please.

So there's a lot you can get excited about — but that doesn't mean you should sign up without considering the full financial weight of opening a new credit card, and what it might mean depending on your lifestyle and spending choices. With any credit card, it's so crucial that you do your research and know what you're signing up for — so make sure it's the right fit for you.

You can find out more about the Apple Credit card and the application process on its website.