Chances are you had a piggy bank as a kid. You know, the kind with a coin slot on top and a cork on the bottom. Or maybe it was a plastic machine that sucked up dollar bills, ATM-style. Either way, the nostalgia surrounding piggy banks is strong.

Not only was it your first way to save money, but piggy banks are also notoriously colorful and cute. Since opening a real bank account as an adult you likely forgot all about your old way of saving money, relegating it to the back of your closet. But many people on TikTok are bringing piggy banks back — and with good reason.

On Feb. 24, creator @secretlyadri made a video about putting money in her piggy bank, and it went viral with over two million likes. “I can’t save money to save my life,” she said while putting crisp 20s inside. “There goes my weekly Starbucks, my boba, my cocos, a mini shopping spree, and everything else I wanted.” In an instant, the money was locked away behind a passcode.

While she seemed sad about it at the moment, the creator made the most of her new saving hack by bedazzling her pink piggy bank with colorful gems. “I just bought [the same bank] because of you,” one person wrote in her comments. “I need this,” another said. “I keep taking my money out of my savings account and my money binder.”

It’s such an old-school way to save, but it also seems to work. Keep scrolling to find out what a financial expert thinks about the piggy bank trend.

Piggy Banks Are The Cutest Way To Save

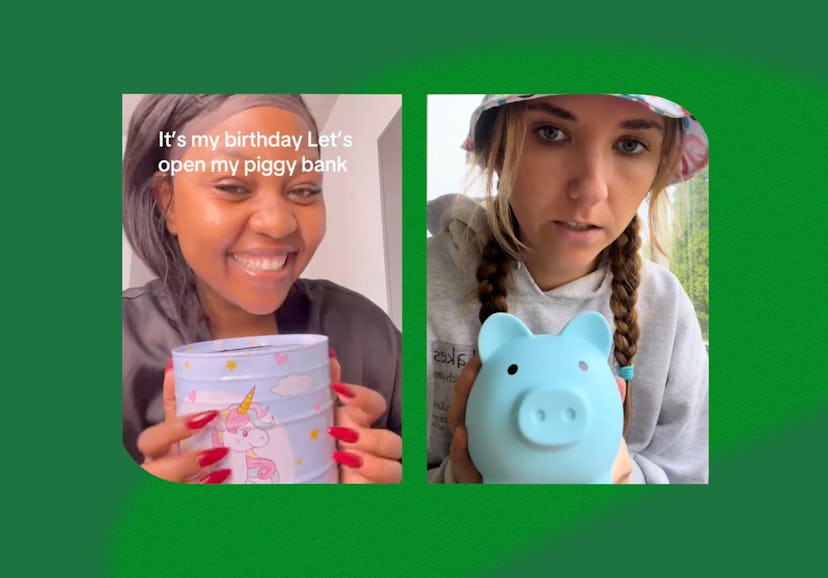

So many creators have hopped on the piggy bank trend, like @cuterozay7 who opened a cute unicorn piggy bank on her birthday to find a load of cash, as well as creator @meginnewengland who said she stuffs money in her classic clay piggy bank whenever she has it on hand. After filling it up 11 months, she opened her piggy and pulled out a whopping $700, which she promptly deposited into a high-yield savings account.

According to Kristy Kim, CEO and founder of TomoCredit, it makes sense why this trend is taking off. “While traditional bank accounts offer savers both security and interest, a piggy bank adds a tangible, visual element to saving that can make the process more engaging, rewarding, and connect us back to nostalgia from our childhood — and we all know how powerful nostalgia is,” she tells Bustle.

It’s also a simple way to tuck away spare change that might otherwise go to impulse purchases. Stuffing cash into a cute piggy bank could be less time-consuming than depositing it at the bank. “Plus, the act of physically dropping cash into a piggy bank creates a sense of accomplishment, which just makes saving feel more rewarding,” says Kim.

Whether you’re saving for a rainy day, a special treat, or a vacation, Kim says using a piggy bank is a playful way to complement other, more structured financial strategies, which often don't feel as fun. You might also be surprised by how much you save.

Making The Most Of Your Piggy Bank

To get started, choose the type of piggy bank that appeals to you. While a traditional piggy bank is quite literally pig-shaped, your at-home bank can take many forms. Some people like a digital toy ATM, others keep a cute can or a clear canister, and some have a metal box.

“Some piggys also come with digital screens that display your savings in real-time, making it even more motivating to watch your balance grow,” says Kim. “This visual feedback can create a sense of achievement and encourage consistent saving habits, which makes you actually excited to save instead of dreading it.”

If you think you might feel compelled to dump out money regularly, get one with a digital passcode or a metal box that’s tough to open. If you’re looking for cute decor, choose a classic ceramic piggy bank that you can keep forever.

Then, start stuffing in coins and bills. Grab the random dollars from your coat pocket, dump in the coins that are hanging out on your counter, deposit the wad of cash you got after making an in-store return, or use it as a place to store your cash tips, like creator @katy.schu who got a cute blue piggy bank to save money from work.

When you open your piggy bank is up to you. “You can open it when you’ve reached a personal savings milestone, like funding a small treat or covering an unexpected expense, or simply whenever you feel it’s time to put the cash to better use,” says Kim. “Some people set certain rules, like ‘cracking’ it open at the end of each month or when it’s full.” Of course, you could also use it as a backup fund when you need money fast.

“The beauty of a piggy bank is that it turns saving into a continuous, stress-free habit, making it easy — and super fun — to stash away extra cash every day,” she adds. “It also makes small amounts, like change, feel very worthwhile!” So start counting your pennies.

Source:

Kristy Kim, CEO & founder of TomoCredit