Viral

This TikTok-Viral Money Hack Only Requires The Notes App

Save money and treat yourself.

If you’re a big shopper who’s always adding things to your cart, filling tabs with must-have items, and ultimately spending more money than you’d like to, then you already know how quickly your purchases can add up. Nothing beats the rush of an in-the-moment splurge, but according to TikTok, there might be a way to get that same feeling while saving your coin.

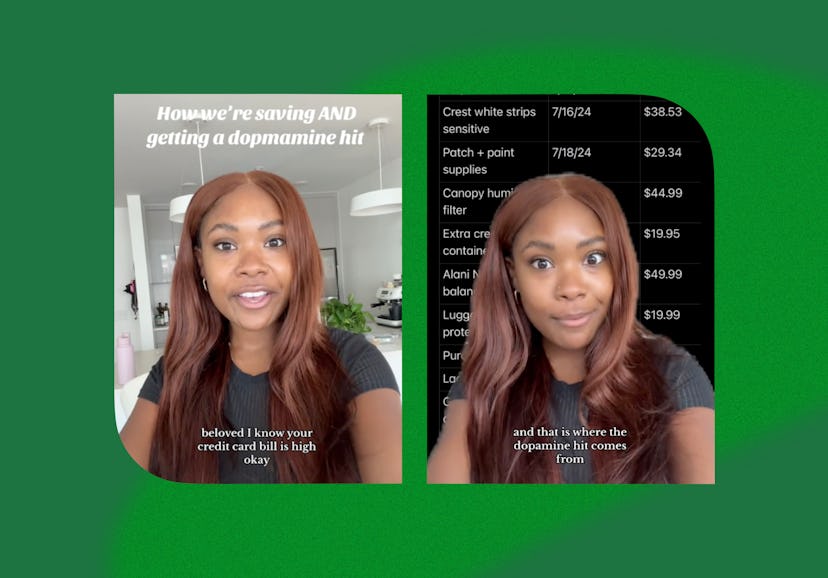

In a video posted July 22, creator @averagesisi, AKA Sierra, shared her best tip for saving money that leaves room for the occasional shopping spree, and all you need to get started is the Notes app on your phone. “This is how we’re going to save money and also get that dopamine hit,” she says in the TikTok, which has over 174,000 likes. “Because oftentimes we don’t really want the thing — we want the dopamine we’ve attached to it.”

Instead of buying something in the heat of the moment, she recommends adding the item to your notes app and letting it sit. This isn’t a novel idea. Financial gurus recommend waiting a few days or making a list of wanted items before buying. By taking a second to breathe, you’re less likely to shop impulsively and waste money. But Sierra’s tip goes one better.

Instead of simply adding the item to a list, you also note the date you saw it and its price. Then, at the end of the month, you add up the cost, put half of that total in savings, and the rest you’re free to spend on whatever you want. It’s a reward, she says, for slowing down and being more mindful of your spending.

In her comments, one person wrote, “[This is] GENIUS. My ADHD thanks you profusely for this, queen.” Another person said, “Wait... this could work on me,” while another wrote, “Oh snap! I thought the dopamine hit was just to see how much you saved! Anddd we get a treat? You onto something.”

How To Save Money With Your Notes App

To try this viral money-saving trick for yourself, go into the Notes app and tap the “Table” option. Only two columns and rows will pop up, but you can easily add an extra column — and as many rows as you need — by tapping the screen and hitting the three dots.

Start with three columns across and one row. In the left column, list the item you want. In the middle, put the date you saw it or added it to the cart. And on the right, how much it costs. Throughout the month, as you peruse TikTok, Pinterest, and your favorite stores, try adding the items you see to this table instead of buying them immediately.

For Sierra, it looks like she wanted to get a wall shelf on July 15 and paint supplies on July 18, among other things. Your list might have pricy items worth hundreds of dollars, like a new purse or a fancy desk chair, or cheaper things, like a viral lip balm or cute reusable bags. To make the most of this hack, keep track of it all.

At the end of the month, add up the right-hand column to see how much everything would have cost if you actually went through with each sale. For the month of July, Sierra almost impulsively bought over $750 worth of stuff. While looking over her list, she could see her shopping patterns and also how much she saved.

Save Money, But Also Treat Yourself

While most people would stop there and simply appreciate how much money they saved, Sierra recommends taking a few more steps — and this is why her hack is extra genius. After you marvel at your grand total, divide it in half and put one half into your savings account.

The goal of this hack is to save money and break your impulse shopping habit. You can use your savings to pay off your credit card or other bills, or simply let it sit for a rainy day. The best part, though, is that you get to spend the other half on whatever you want. “Half is important because you’re honoring your commitment to save, and then also rewarding yourself for that,” she says. “And that is where the dopamine hit comes from.”

To treat yourself, go through your list and pick out all the things you really love and allow yourself to get them — as long as they’re within budget. Chances are you’ll have forgotten about most of the items, which is an important reminder that you probably don’t really “want” or “need” half of what you see.

If you still like something by the end of the month, however, it’s a good sign it might add to your life meaningfully. Or, at the very least, it’ll be something that genuinely gets you excited. You’ll also appreciate these items so much more because you waited for them.

Some months your list might only have a few things on it. Other times it might have hundreds — and that’s OK. “If your list gets long like mine you’re not going to shame yourself, right, because we live in an age where we’re constantly being sold to,” Sierra says. “That is not your fault, but it is your responsibility to make sure you keep yourself on track for your financial goals.”