Money

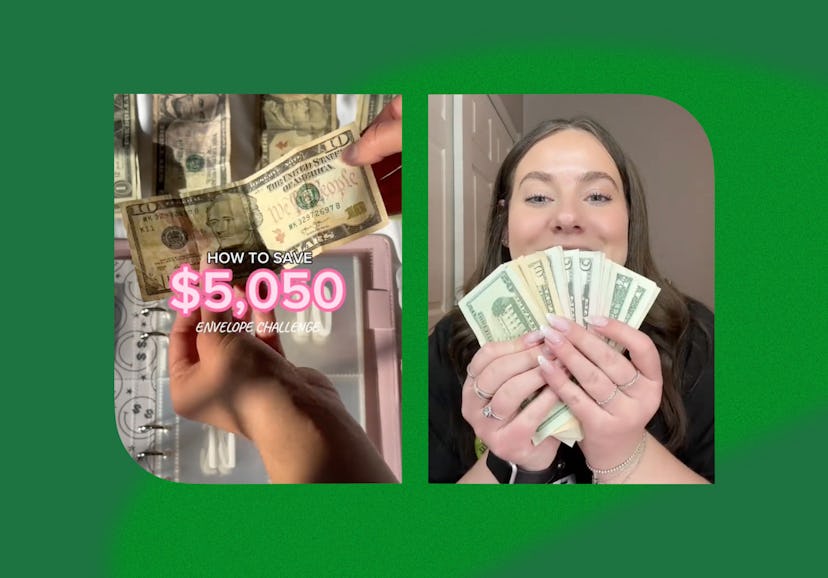

The TikTok-Viral "100 Envelope Challenge” Money Hack, Explained

“I’m the type of person who finds it easier to save money if I can see the cash in front of me.”

Are you a bit of a slacker when it comes to saving money? If so, you aren’t alone. It’s so easy to buy things you don’t need, spend a little too much on clothes, and order DoorDash multiple nights a week — and just like that you’re out hundreds of bucks. If you’ve been meaning to change your ways and set aside more money, it could be as easy as the “100 Envelope Challenge” from TikTok.

This viral money-saving trick promises to help you stash away $5,050 in 100 days. The idea is to label 100 envelopes — one through 100 — and each day you fill an envelope with the corresponding amount of money. So $1 on day one, $2 on day two, $3 on day three, and so on until you fill the 100th envelope on the 100th day with $100.

Some people like to use a special binder made specifically for this challenge, like @budgeting.money who showed off her binder with its 100 numbered slots. “I try to put in as much money as I can every time I have spare change,” she says in her video, which has over 100,000 likes. “This does help save so much money, and that’s a good habit to get into.”

In her comments, one person said, “I loooove this,” while someone else said, “I have one [of these binders] but I always just take the money out and spend it.” And that’s why this is a challenge in every sense of the word. Once those bills are in the envelopes, you have to be strict with yourself and not take them out. It’s also a challenge to come up with the cash, which means you need to adjust your spending habits.

How To Save $5,050

The 100 Envelope Challenge is all about shifting from a spending mindset to a saving mindset. Instead of dropping $17 on a bagel and coffee, put the $17 in your Day 17 envelope. Instead of splurging on $37 worth of makeup at Sephora, tuck that $37 away in your Day 37 envelope. If you’re someone who carries cash — this challenge is perfect for servers, baristas, etc. — then you’ll already have actual money on hand. If not, it’s as easy as going to an ATM after payday.

Step 1: Make Your Envelopes

TikTokers are big fans of the pre-made 100 Envelope Challenge binders, which are available on Amazon and in the TikTok shop. These binders come with see-through labeled slots and a handy checklist so you can keep track of the days you’ve filled. Some people prefer to label their own envelopes while others like to keep all of their bills neatly stored in a plastic container.

Step 2: Start Filling The Envelopes

To complete this challenge, most people go in order by adding $1 to the first envelope on the first day, $2 to the second envelope on the second day, and so on, but you can also turn this challenge into a game by pulling an envelope at random, like TikToker @megannicolee21. When she gets home from her serving job she takes her tips, pulls an envelope out of a box, and fills it up with the corresponding amount of money.

Sometimes it works in your favor to go out of order. If you have a crisp $20 burning a hole in your pocket, it’s a good idea to put it in your Day 20 envelope before you can spend it. If you get a $50 bill for your birthday, quickly stick it in the Day 50 slot before you get any big ideas.

It’s also helpful to go in reverse. Creator @twirlwindgourmetcc started on Day 100 and worked her way backward. “I feel like get the hard stuff out of the way, and it’ll get easier and easier,” she said. “You can do the 100 envelope challenge any way you want to do it.”

Step 3: Keep Going

Stick with your 100 Envelope Challenge until each slot is filled — and let yourself feel excited and encouraged by your ever-growing pile of dough. For extra inspo, keep in mind that you only have to do this for one hundred days. While it might seem daunting at first, chances are you won’t miss the $12 you would’ve otherwise spent on snacks at the bodega.

Step 4: Don’t Touch It

This challenge encourages you to save real cash instead of simply moving money around in your savings account so you can physically witness it adding up. On TikTok, @alliehoffberg said, “I’m the type of person who finds it easier to save money if I can see the cash in front of me. It makes it easier not to spend it.”

It’s so easy to mindlessly swipe your debit card as you go about your day, but collecting cold, hard cash can make you more intentional about reaching your goals. Just make sure you don’t cave and dip into your envelopes in a moment of weakness. Once your cash is in an envelope, it’s off-limits.

Step 5: Keep It Safe

Since this is real money we’re talking about, you’ll definitely want to keep your binder or envelopes in a safe place, like in a lock box or hidden in a drawer. To be extra safe, don’t carry it around or leave it lying on a table.

Does It Always Work?

If you don’t have enough income to stash money every day for 100 days, feel free to extend the deadline. Fill your envelopes whenever you can and you’ll eventually reach your $5,050 goal.

To successfully save money, it’s also important not to shift your spending elsewhere, like to a credit card. It won’t make sense to tuck $75 worth of cash into your binder while also swiping your card for the same amount.

According to an article by USA Today, there’s no point in doing this challenge if you’re going to go into debt in the process. The goal is to cut back on needless spending in general so your money adds up faster.

What To Do With Your $5,050

Many people start the 100 Envelope Challenge with a goal in mind. On TikTok, @carsyn_hall said she’s saving up for a car while @griffinarnlund said she’s going to use part of her $5,050 to go on vacation. It’s OK to do this challenge just for the fun of it or as a way to save cash for something you truly need.

This challenge is also an ideal way to add money to your savings account or emergency fund. According to USA Today, many people lack a sufficient emergency fund, which should equal about three-to-six months of essential expenses — like bills, rent, gas, etc. This is the money that’ll cover you if you lose your job or need to pay for something unexpected, like a major car repair.

To set aside money for a rainy day, take your $5,050 to the bank and deposit it in a high-yield savings account. With that amount of cash tucked away, you should feel a lot more financially secure.